Overview

Our State of Independent Practice Ownership found much anxiety about the state of the industry.

- Over a third of respondents viewed the state of independent healthcare practitioners as poor or terrible.

- Nearly half considered the independent healthcare model to be at least somewhat threatened.

- More than a third of practice owners anticipate growth this year.

- A majority of practice owners expect to remain independent over the next 5 to 10 years.

- 59% know a practice owner that retired, and 54% know a practice owner that had sold their share of the practice to a large healthcare provider.

When we launched The Intake — the website you’re currently reading — our goal was simple: to provide a daily source of research and information on the business of running an independent healthcare practice.

But as we embarked on that mission, we quickly ran into a big, unanswered question: What is the current state of independent practice ownership?

To our dismay, there was little research on this topic. And what was available, the prognosis was not good.

According to the Physicians Advocacy Institute, approximately 75% of medical physicians are considered employees rather than owners. This represents a significant change in ownership structure compared to 2005, when physician-owned practices accounted for two-thirds of the total.

The Covid-19 pandemic seemed to exacerbate this trend, with well over 100,000 more physicians leaving private practice to become an employee. More than half of practices are owned by large hospital systems or private equity corporations. Similar consolidation trends are occurring in other parts of the healthcare sector, such as dentistry and physical therapy.

There’s no question consolidation is happening. But there are plenty of questions about how independent practices deal with it.

Those are the questions we set out to answer with our research. We surveyed 112 independent healthcare practice owners and compiled our first State of the Independent Healthcare Practice Ownership report. What we discovered is that independent practices are in a state of high anxiety about their industry.

But that’s the short answer, and the nuances are many.

The majority of independent practice owners say the industry is threatened

When asked about the state of independent healthcare practitioners today, over a third of respondents viewed the state of independent healthcare practitioners as poor or terrible, while 32% found it acceptable; 27% considered the industry good, and only 6% rated it as excellent.

Many practice owners expressed concern about the industry's future: 8% found it extremely threatened, while 21% believed it to be very threatened. Nearly half (44%) considered the independent healthcare model to be at least somewhat threatened. Only a small percentage, 6%, believed it faced no threat at all.

"Independent practice owners are, by many metrics, correct in assessing the state of the industry as threatened," says Lauren Wheeler, a former family medicine physician who currently works as a healthcare advocate and medical editor.

"Decreasing Medicare and Medicaid payments, whether in absolute terms or relative to inflation, poses a dire obstacle to the independent practice owner because these are the insurance rates that they don't have to independently negotiate for their practice every year or two. Contrast that to the myriad of private insurance options with variable reimbursement rates and innumerable rules and exceptions, and it becomes clear why private practices both choose to cater to those with public insurance and are hurt by reimbursement changes."

“Independent practice owners are, by many metrics, correct in assessing the state of the industry as threatened.”

Despite ongoing industry anxiety, our research reveals a significant gap between practice owners' perceptions of the industry and the state of their own practice.

Most practice owners gave solid marks for their practice with 44% rating their practice as good, 18% as excellent, and 31% finding it acceptable. Only 7% rate it as poor, with no respondents considering it as terrible.

More than a third of practice owners anticipate growth

Many practice owners anticipate growth this year, with 37% anticipating increased revenue, 28% expecting to grow profitability, 27% planning to add new providers, 22% anticipating adding new services, and 6% intending to establish new offices or locations. However, 36% of respondents say they don’t anticipate any growth this year.

Unsurprisingly, those who don’t anticipate growth were more likely to give negative marks to the state of the independent practice industry. Among those who say the industry was poor or terrible, 51% and 50% were those who didn’t anticipate growth at their own practice, respectively.

Independent practice owners expect to stay independent

Despite pessimistic views of the industry, a majority of practice owners expect to remain independent over the next 5 to 10 years. A total of 26% find it completely likely, 30% find it very likely, and 25% find it somewhat likely. Only 19% say it was unlikely, with 11% selecting hardly likely and 8% selecting not at all likely.

This contrasts with what most practice owners state they’re actually seeing in the industry: 59% know a practice owner that retired, and 54% know a practice owner that had sold their share of the practice to a large healthcare provider.

Nearly half (46%) know a practice owner that closed their practice and 42% know an owner that quit to work for a large healthcare organization.

Only 39% know an owner that sold their practice to a partner or another independent practice, and just 30% knew a provider that left a large healthcare organization to open an independent practice.

"Becoming a physician was once synonymous with a high income, providing a substantial return on the significant investment of time and money required to earn a medical degree," says Baran Erdik, a physician with specialization in Internal Medicine/Cardiology.

"However, this reality is shifting. A growing number of physicians are becoming salaried employees, often within large healthcare systems, rather than owning private practices. This trend is driven in part by the increasing financial pressures associated with running a private practice, including rising medical school debt, operational costs, and declining reimbursement rates."

Low reimbursement rates loom large

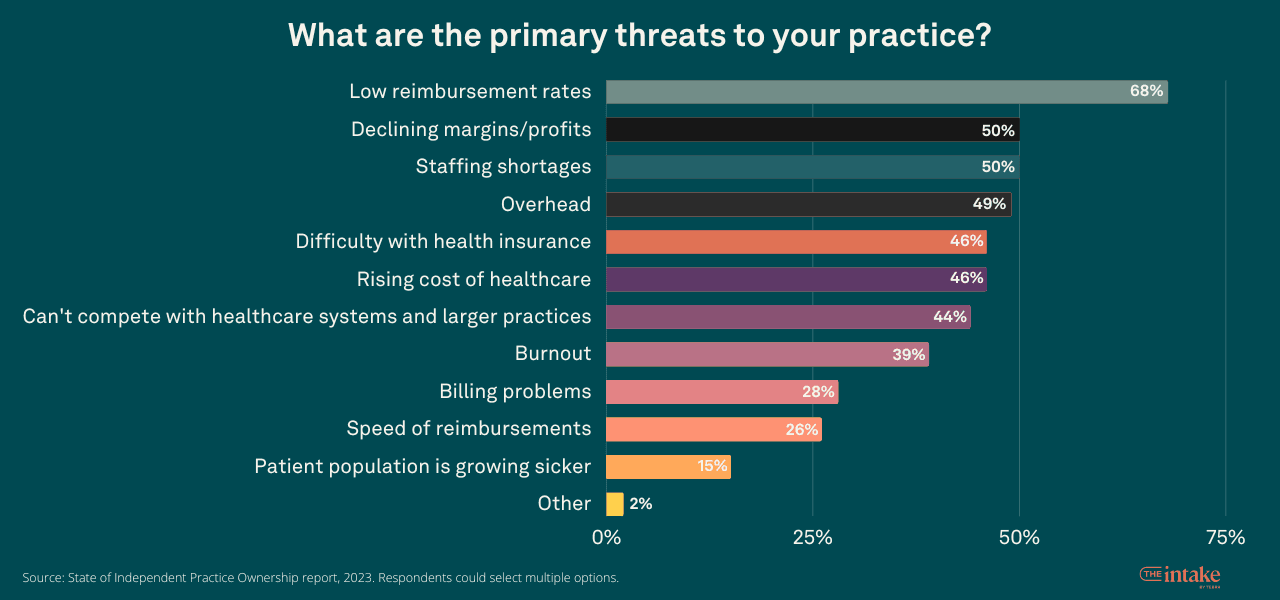

The primary threats to independent practices, as cited by owners, are low reimbursement rates (68%), declining margins/profits, and staffing shortages (both at 50%). Other concerns include overhead (49%), difficulty with health insurance and rising healthcare costs (both at 46%), and competition with larger healthcare organizations (44%).

Low reimbursement rates cause significant pain, as shown in the survey. The majority (68%) of practice owners want improved reimbursement rates.

And they double down when asked about the importance of this issue. Among all the improvements they would like to see for helping independent practice owners, improved reimbursement rates rank highest among “most important” improvements.

Other studies support this finding. A study by the American Medical Association draws a direct line between the diminishing number of private practices and issues with payments, stating that 80% of physicians cited the need to better negotiate favorable payment rates with payers as a very important or important reason for selling their practice to a larger hospital system.

One respondent to our survey summarizes well why reimbursement rates are such a taxing burden for independent practices:

“As a small practice, I do not employ dedicated staff to chase payments, chase authorizations, or conduct utilization reviews. … When small practices spend this time we are not (as providers) generating income, we are losing clinical time. It is an economy of scale issue that makes it hard to stay viable.”

Of the practice owners who said they’d experience no growth this year, 65% cited “overhead” as a primary threat. This is particularly salient as often independent practice owners are set up as employees of the practice and drawing a salary. Decreased reimbursements or increased overhead affects them as much as any employee in that model.

Burnout not the top issue for many independent practices

There’s precious little research on the differences between burnout levels of independent practices and those run by large hospital systems or corporations. What does exist suggests that independent practices report lower levels of burnout than employed providers of a few percentage points to a truly wide gap.

A recent survey run by Tebra found that 42% of hospital system employees are considering switching to private practice, mostly due to the need for a better work-life balance.

Our research supports the hypothesis that burnout is less of a factor in private practices. Among the primary threats to their practices, owners mark burnout near the bottom at 39%, behind difficulty with insurance (46%), rising cost of healthcare (46%), and competition from larger healthcare organizations (44%). Only billing problems (28%), speed of reimbursements (26%) and the patient population getting sicker (15%) rank lower.

While 54% of independent practice owners experience moderate burnout, 19% report hardly any burnout, and 10% claim no burnout. Only 14% are experiencing severe burnout and 3% are experiencing extreme burnout.

And these results are skewed based on the practices’ performance. A large percentage of those reporting extreme burnout — 67% — say the state of their practice is terrible or poor.

Respondents who say their practice is excellent or good reported no extreme burnout. Sixty-two percent of respondents who say they’re experiencing severe burnout say the state of their practice is poor or terrible, while only 25% are in the excellent or good cohort.

Burnout also ranked behind retirement and financial challenges as a reason owners would consider selling their stake in the practice.

Hobbies most cited means for dealing with burnout

To manage burnout, 62% of practice owners engage in outside hobbies. Setting work/life boundaries (57%), practicing good self-care (56%), and engaging in stress-reducing activities (53%) are also effective approaches.

What is lost when independent practice model erodes

Asking any group why their model is better than the alternative is bound to be biased. Still, it’s helpful for understanding what motivates them to invest in the independent practice model.

Unsurprisingly, independent practice owners rate the care they provide patients as superior to the care provided by large healthcare systems and hospitals. More than two-thirds (78%) say their quality of patient care is above average compared to large healthcare organizations, 18% say it is average and only 4% say it is below average.

"I've found that independent practices are often more willing to deploy creative solutions for their low-income, uninsured patients," says Wheeler.

"Big systems can too, of course, but the financial counselor has to build a new relationship with the patient, and that's already in place with a small practice owner who is also the care provider and the financial decision-maker."

Strong patient relationships rank highest among independent owners

When it comes to the ways they provide better patient care, independent practices say they build strong relationships (82%), effectively communicate (70%), and use patient-centered care (67%). They also prioritize preventive care (44%), coordinate care with other healthcare providers (32%), stay current with medical advances and best practices (30%), and utilize technology (23%). No respondents selected "none of the above."

Personalized care tops list of what patients lose

When asked what patients lose out on when not treated by independent practices, 78% of respondents say personalized care. That is closely followed by long-standing relationships at 73%.

Access to the practitioner and healthcare provider are each cited by more than half of practice owners at 55% and 51%, respectively. Flexibility in treatment options is cited by 34% of respondents. Only 4% say nothing is lost.

Quality of care is unchanged even though business is harder

Most practice owners report stable care quality . Among respondents, 64% say the patient care they deliver has been unchanged since 2019, 24% claim improvement, and 12% note a decline.

This is in spite of recognized changes in business conditions for independent practice owners. More than half of respondents (59%) say the pandemic made it harder to compete with larger healthcare organizations. Only 13% say it made it easier to compete, and 28% say it had no impact.

"The COVID-19 pandemic has not only placed financial strains on smaller providers but also accelerated trends of consolidation and attracted private equity investment," Erdik says.

"Together, these factors have created an environment that makes it increasingly difficult for small healthcare providers to compete with large hospital systems. The challenge moving forward will be for regulators to address these issues to prevent the further erosion of competition in healthcare markets."

More than a third of owners are at least somewhat likely to sell their practice

Age and retirement pose significant challenges to the healthcare industry. The average age of healthcare providers is 49 years old. The Association of American Medical Colleges found that 45% of physicians are 55 years old or older, and specialties like psychiatry are even higher with 61% in that age bracket.

The average age of providers across healthcare could have a disproportionate impact on independent practices already under pressure. Our survey found that those trends could indeed soon impact the size of the independent practice space — though the picture is mixed.

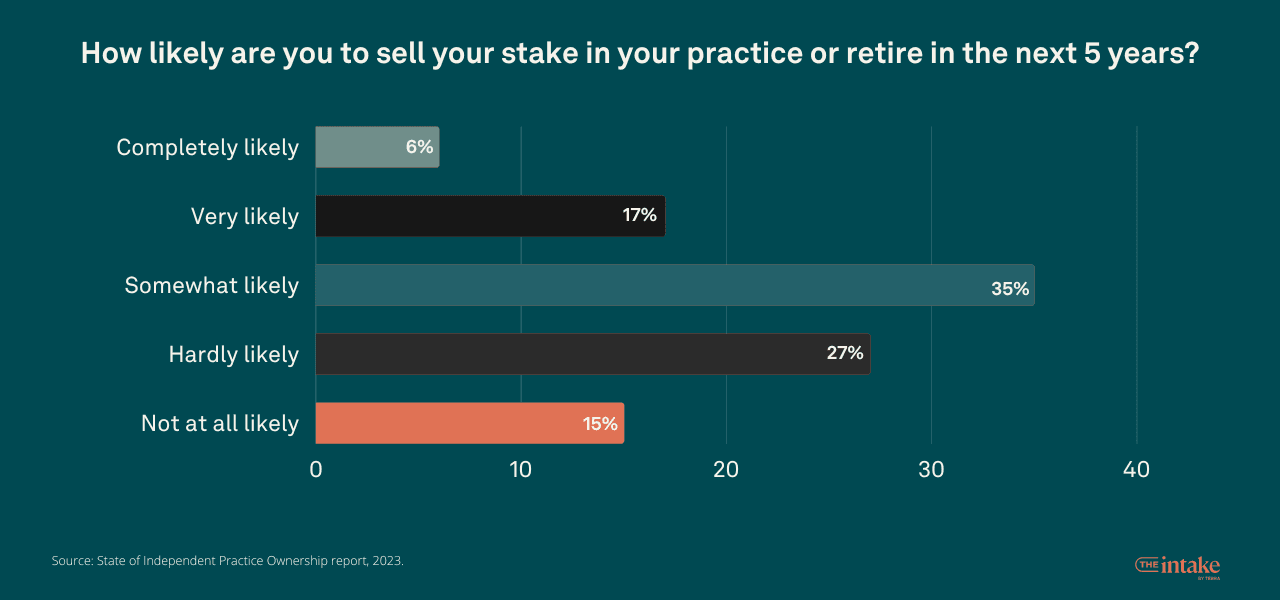

When asked if they’re likely to sell their stake in the practice or retire in the next 5 years, 35% say they’re at least somewhat likely. But another 17% say it’s very likely and 6% say it’s completely likely. More than a quarter (27%) say it’s hardly likely, and 15% say it’s not at all likely.

Most independent practice owners would retire if they sell

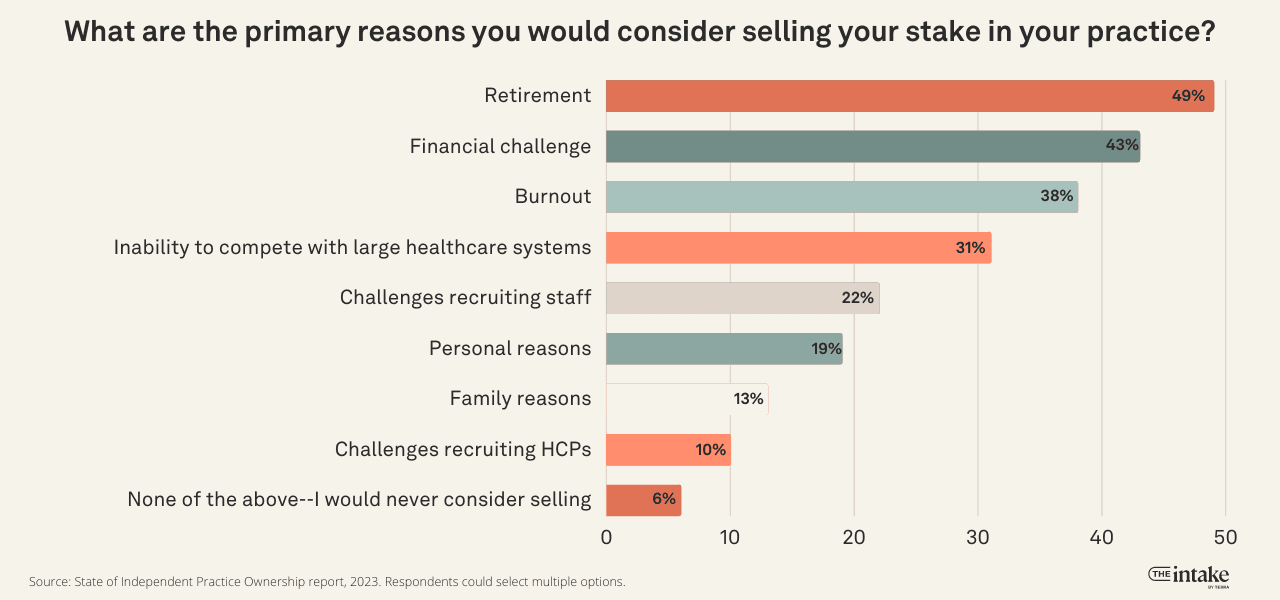

Retirement is cited by 49% of the survey respondents as the primary reason they would sell their stake in the practice.

This was just above financial challenges at 43%, burnout at 38%, inability to compete with large healthcare systems at 31%, challenges recruiting staff at 22%, personal reasons at 19%, family reasons at 13%, and challenges recruiting healthcare providers at 10%. Only 6% say they would never even consider selling for any reason.

On top of that, a majority of owners (64%) say they would retire completely or in part if they were to sell. Only 27% say they would work with the new owners. Another 20% say they would pursue a career outside of healthcare, and 17% say they would volunteer.

Most independent practice owners want to pass the baton

Even though many practice owners would consider selling in the next 5 years, the majority want to pass the baton rather than sell to large healthcare organizations. When asked if they would be more likely to sell to an independent practice or a large healthcare system, 62% say an independent practice.

In the context of the full survey, this suggests the passion for an independent practice model outweighs pessimism based on experience.

As we noted earlier in this report, only 39% know an owner that sold their practice to a partner or another independent practice, compared with 54% who know a practice owner that had sold their share of the practice to a large healthcare provider.

Improved administrative issues would be the biggest help

Independent practice owners rank getting paid and reducing administrative burdens as their top issues. The top 2 changes they want to see to help them remain independent are reduced administrative burdens and improved reimbursement rates (68%).

This is next followed by simplified or standardized coding for medical billing at 54%, lower healthcare costs for patients at 42%, technology designed for independent practices at 41%, greater flexibility in payment models at 34%, more influence in regulations and/or government advocacy at 33%, more education around the business of practice in medical school and/or training programs at 31%, better access to staffing and recruiting pipeline at 29% and improved support for mental health at 20%.

But as noted before, when we ask owners which of these were most important to them, improved reimbursement rates jump ahead of reduced administrative burdens at 39% compared to 23%. No other issue cracks 10% of respondents.

When we ask practice owners to explain why a particular issue is important, the top three cited concerns are cost (15%), reimbursement (14%), and time (14%).

How many patients are independent practices seeing?

Our survey also sought to capture data on the number of patients (panel size) the practice and individual providers serve.

The average independent practice sees over 1,300 patients per month

Across the practice owners in our survey, the average (mean) number of patients seen per month across all locations is 1,375. There’s a lot of variability between the sizes of practices and number of locations, explaining why the median number of patients seen per month is 738.

The number of locations the practice managed impacts the panel size heavily. Those with only one location see fewer patients. Among practices with one location, 22% see fewer than 250 patients per month, 24% see between 250 and 499 patients per month, 33% see between 500 and 999 patients per month, and 21% see 1,000 or more patients per month. Among practices with 2 or more locations, 3% see fewer than 250 patients per month, 3% see between 250 and 499 patients per month, 14% see between 500 and 999 patients per month, and 80% see 1,000 or more patients per month.

It’s difficult to find breakouts of panel size for corporate-owned practices. The American Academy of Family Physicians estimates that ideal panel size, which is measured over 12 to 18 months, would be 1,806.

The average independent practice provider sees 369 patients per month

Among all the practice owners surveyed, the average (mean) number of patients a provider sees per month is 369. The difference between the mean and the median number of patients seen per month, which is 400, was less varied when measuring per provider versus per practice.

Of the providers at practices with only one location, 31% see fewer than 250 patients per month, 39% see between 250 and 499 patients per month, and 31% see 500 or more patients per month. Among providers at practices with two or more locations, 14% see fewer than 250 patients per month, 34% see between 250 and 499 patients per month, and 51% see 500 or more patients per month.

Who answered our survey

All participants in our survey work within a private practice and identified as having at least some ownership stake in the practice. Among those, 48% say they own all of their practice, 12% say they own more than half, 19% say they own half, and 21% say they own less than half.

The majority of the respondents (73%) identified as physicians. This is followed by specialists at 6%, psychologists at 5%, clinicians at 5%, nurse practitioners at 4%, and lab technicians at 1%. 5% identified as “other.”

Among those providers, 67% say their practice has one location, 13% have 2 locations, 8% have 3 locations, 3% have 4 locations, and 8% have 5 or more locations.

Employee count at the practices varies with 28% reporting fewer than 5 employees, 21% with 5-9 employees, 23% with 10-19 employees, and 28% 20 or more employees.

You might also be interested in

- How patients find and pick their doctors. We surveyed more than 1,200 patients nationwide to understand factors that influence how they choose a doctor and why they keep coming back. Download the free report.

1Methodology: The survey that forms The State of Independent Practice Ownership report was conducted by a third-party research firm, Researchscape International. It was fielded from April 14 to May 2, 2023. There were 112 respondents to the survey. The survey results were not weighted. As this was not a probability-based sample, calculating the theoretical margin of sampling error is not applicable. However, as with probability surveys, it is important to keep in mind that results are estimates and typically vary within a narrow range around the actual value that would be calculated by completing a census of everyone in a population. One estimate of this precision is the credibility interval; for this survey, the credibility interval is plus or minus 13 percentage points for questions answered by all respondents (the interval is larger for questions answered by fewer respondents). Again, as with probability surveys, on occasion the results from a particular question will be completely outside a typical interval of error. Many types of survey errors can limit the ability to generalize to a population. Throughout the research process, Researchscape followed a Total Survey Quality approach designed to minimize error at each stage. Total Survey Quality, also known as Total Survey Error, recognizes that multiple sources of error can reduce the validity of survey research. Besides sampling error, five types of non-sampling error can occur: specification error, frame error, nonresponse error, measurement error, and processing error. At each step in the survey research process, the research team followed best practices and used quality controls to minimize the impact of these sources of error. To minimize frame error, respondents were recruited from a diverse variety of different sources (panels, apps, websites, and reward programs). Panel surveys sometimes suffer from inattentive respondents or spam. Researchscape used a combination of automation and analyst review for data cleansing, profiling responses on five behaviors (inattentiveness, speed of response, straight-lining, poor verbatim responses, and suspicious activity). Any respondent committing two or more penalties was removed from the data set; research on research has shown that results are less representative when excluding respondents who commit one penalty, as any one behavior might be typical of that respondent or a momentary lapse of attentiveness. Researchscape is confident that the information gathered from this survey can be used to make important business decisions related to this topic.